UK Salaries Explained: Why Does My Take-Home Pay Feel So Small?

Last updated: November 2025

Let’s be honest… many of us arrive in the UK with big dreams, big hopes — and then the first payslip arrives.

You open it, expecting numbers that make you smile… and instead:

“Wait… who took my money? Where did it all go?”

Welcome to the Great British Payslip — a uniquely confusing combination of taxes, deductions, acronyms, and mysterious line items nobody warned you about.

In this article, we break down exactly how UK salary works, why your take-home pay is smaller than you expect, and what you can realistically bring home each month.

We will try to explain this in the most simplest way possible (some even with examples) — perfect whether you’re planning to move, already working in the UK, or supporting a partner or child living here.

Related tool:

👉 UK Take-Home Pay Calculator — instant breakdown with full tax details

👉 London Cost of Living Calculator — see whether your salary fits London life

⭐ Why Your UK Take-Home Pay Shrinks So Much

If you’re used to living in places with lower or simpler taxes, the way things are deducted here can feel like a bit of a shock at first. A UK salary always looks great on paper (the numbers look bigger because it’s shown annually) — until it reaches your bank account.

Here’s what typically gets deducted:

1. Income Tax

This is a progressive tax system — the more you earn, the higher the rate for the top slice.

2. National Insurance (NI)

Think of this as the UK’s version of social security.

It funds things like the NHS, state pension, unemployment support, etc.

Most newcomers forget that NI is on top of income tax, so the total deduction feels heavy.

3. Pension Contributions (Auto-Enrolment)

If you work in the UK, your employer must automatically enrol you into a pension scheme.

Good news:

- your employer contributes too

Bad news: - it still reduces your take-home pay each month

4. Salary Sacrifice (optional but common)

These reduce taxable income — but also reduce the cash you take home monthly, More on this later.

⭐ What’s Considered a “Good Salary” in the UK?

This depends on lifestyle, location, and whether you have dependents.

London has very different numbers compared to the rest of the UK.

Here’s a simple way to think about salary levels in the UK, whether you’re already here or planning to move.

What Does a “Good Salary” Look Like?

| Salary Range | What It Means | Typical Lifestyle Fit |

|---|---|---|

| £25,000 – £30,000 | Entry-level or early career | Comfortable outside London; tight in central London unless flat-sharing |

| £40,000 – £55,000 | Common UK professional salary | Manageable for singles/couples in London with budgeting |

| £60,000 – £90,000 | Mid–senior professional | Comfortable for families; tax impact becomes noticeable |

| £100,000+ | Senior/ specialised roles | Strong salary but heavily taxed; net income % drops sharply |

Want to see your exact numbers?

👉 Try the UK Take-Home Pay Calculator

⭐ Understanding the UK Payslip

Here’s what typically appears on your monthly payslip:

⭐ Understanding the UK Payslip

| Gross salary | Your full salary before any tax or deductions are taken out. |

| Tax code |

This tells HMRC how much tax to take. Common examples for the current tax year (e.g. 2025–2026): • 1257L – standard tax code • BR – taxed at basic rate on all income • 0T – no personal allowance (often temporary) • D0 / D1 – higher or additional rate applied to all income • K codes (e.g., K250) – means you owe HMRC from previous year Full HMRC guidance: https://www.gov.uk/tax-codes |

| PAYE (Income Tax) | Your main Income Tax deducted automatically each month. |

| National Insurance | A separate deduction paid alongside tax. |

| Pension | Money put into your workplace pension. Most contribute 3–5%. |

| Student loan | Deducted only if you have a UK student loan and earn above your repayment threshold. |

| Other deductions | Salary sacrifice, benefits, travel loans, bike-to-work scheme, company perks, etc. |

💡 Salary Sacrifice — One of the Most Useful (and Misunderstood) Benefits

Salary sacrifice allows certain benefits to be deducted from your gross salary, not your net.

Salary sacrifice allows some benefits to be deducted from your gross salary rather than your net — so you save income tax and usually NI as well (with a new NI cap for pension salary sacrifice from April 2029).

Here’s how each option works in real life, with examples.

🚗 Salary Sacrifice: Electric Vehicle (EV) Lease

EV salary sacrifice is currently one of the most generous benefits.

Example:

Retail/private personal lease price: £650/month (without insurance)

Through salary sacrifice:

- Save ~32% (basic-rate) → net cost ~£440

- Save ~42% (higher-rate) → net cost ~£380

👉 You effectively get a £650 car for either £440 or £380.

Often includes insurance + maintenance.

🚲 Salary Sacrifice: Cycle-to-Work Scheme

Savings are proportional to the price of the bike, benefiting both commuters and hobby cyclists

Examples:

- £1,000 bike → save ~£320–£420

- £3,000 bike → save ~£950–£1,250

- £10,000 bike → save £3,200–£4,200

Many people essentially get a quality bike at a huge discount — and spread the repayments interest-free.

👶 Salary Sacrifice: Childcare Support

Childcare in London is extremely expensive; salary sacrifice can ease the burden.

If you sacrifice £500/month:

- Real cost becomes £350–£400 after tax + NI savings.

🏦 Salary Sacrifice: Pension

Updated on 28 November 2025 - Post UK Autumn Budget 2025

This is one of the smartest ways to save tax in the UK.

Your contribution is taken from your gross income, and your employer adds their portion.

Let’s use a £4,000/month salary example.

Pension Salary Sacrifice Examples (Based on £4,000/month salary)

| Employee Contribution | Amount You Pay | Employer Contribution | Drop in Take-Home | Total Monthly Pension Growth |

|---|---|---|---|---|

| 3% | £120 | £160 | ~£80–£95 | £280 |

| 10% | £400 | £160 | ~£270–£300 | £560 |

| 16% | £640 | £160 | ~£430–£480 | £800 |

🧠 Is pension tax-free?

- Tax-free when contributed

- Grows tax-free (compounding)

- At retirement:

- 25% tax-free

- 75% taxed at your (usually lower) retirement rate

From 6 April 2029, only the first £2,000 of pension contributions made via salary sacrifice will be exempt from employee NI. Income Tax relief remains unlimited.

Quick examples:

1) Under the cap — no change

- Aisha earns £38,000 and sacrifices £1,900 a year.

- £1,900 is under the cap → still 0% NI on this amount.

- Her take-home pay stays exactly the same before and after April 2029.

- Change in take-home pay: £0 per year (no monthly drop).

2) Above the cap — moderate impact

- Ben earns £70,000 and sacrifices £7,000 a year.

- Only the first £2,000 stays NI-free.

- The remaining £5,000 has NI charged (using ~8% as a simple example).

- This equals roughly £400 extra NI per year.

- Change in take-home pay: about £400 per year (around £33 per month).

3) High earners contributing large amounts

- Sophie earns £150,000 and sacrifices £30,000 a year into her pension.

- Before April 2029, the full £30,000 avoided employee NI (saving roughly £2,400 at 8%).

- From April 2029, only the first £2,000 is NI-free.

- The remaining £28,000 will now be charged NI (again using ~8% for simplicity).

- That’s about £2,240 extra NI per year compared with the old rules.

- Change in take-home pay: about £2,240 per year (around £187 per month).

🚇 Salary Sacrifice: Season Ticket Loans

Great for daily commuters — not always worth it for hybrid workers.

Good for daily travel

- Annual Zones 1–4 pass: ~£2,300

- Salary sacrifice makes it cheaper

- Can use on weekends too

- Saves ~£300–£500/year

Not good for hybrid work

If you commute 2–3 days/week:

Pay-As-You-Go is usually cheaper (~£50–£80/week).

Rule of thumb:

Daily commuter → Season ticket

Hybrid worker → Contactless PAYG

⭐ Why Your Net Salary Doesn’t Increase Much After a Pay Rise

An amusing truth:

A £5,000 pay rise never feels like £5,000 extra in your pocket.

Because once your income enters higher tax bands, the UK government takes a bigger slice from that last £5k.

For example:

- Basic rate: 20% income tax + NI

- Higher rate: 40% income tax + NI

- Additional rate: 45% income tax

What a £5,000 Pay Rise Actually Looks Like

| Salary Increase | Net Yearly Increase | Net Monthly Increase |

|---|---|---|

| £45k → £50k | ~£3,000 | ~£240–£260 |

| £70k → £75k | ~£2,500–£2,700 | ~£210–£230 |

If you cross income thresholds like £100k, £125,140, or similar, tax planning becomes important — especially if you have children (because childcare benefits phase out as income increases).

⭐ Real Monthly Take-Home Examples

Here are ballpark figures based on common UK salaries:

Approximate Monthly Take-Home Pay (After Tax & NI)

| Gross Annual Salary | Approx. Monthly Take-Home | Notes |

|---|---|---|

| £30,000 | ~£1,950 | Basic rate taxpayer |

| £45,000 | ~£2,850 | Very typical UK salary |

| £60,000 | ~£3,650 | Higher tax kicks in |

| £80,000 | ~£4,650 | Larger NI + 40% tax band |

| £100,000 | ~£5,450 | Personal allowance tapering begins |

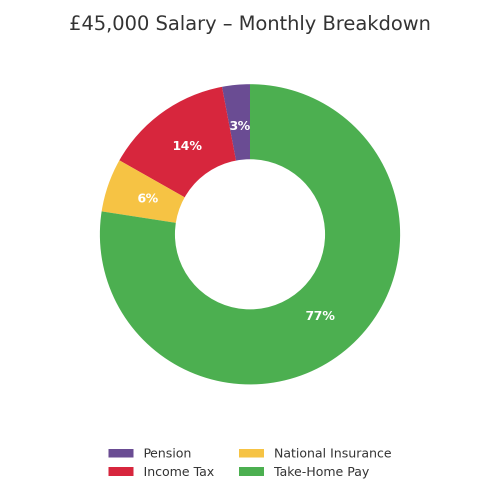

£45,000 Salary

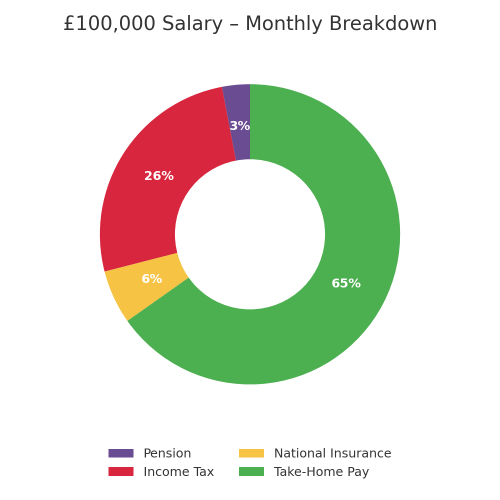

£100,000 Salary

Here’s a quick way to see it: as your income goes up, the green “take-home” part of the doughnut gets smaller. It’s a simple visual showing how tax takes a bigger bite at higher salary levels.

These are estimates — your actual numbers depend on NI thresholds, pension contributions, and salary sacrifice choices.

To help calculate yours:

👉 Use the UK Take-Home Pay Calculator

⭐ London vs Outside London: The Reality Check

A £60k salary outside London feels very comfortable.

In London… it feels more like £40k.

Major cost differences:

- Rent

- Childcare

- Transport

- Food

- After-school clubs

- Commuting

- School catchment expectations

To estimate real living costs:

👉 Try the London Cost of Living Calculator

This will give you a realistic view of whether a job offer in London is enough for your family.

⭐ Why Some Families Feel “Tight” Even on Good Salaries

Because the UK has a high base cost structure, especially for families with small children.

Childcare alone can be £1,500–£2,000/month per child before government subsidies.

This is why many professionals use:

- salary sacrifice

- childcare vouchers

- tax-free childcare

- employer benefits

- electric vehicle schemes

These reduce tax and NI significantly.

⭐ Final Thoughts

The UK salary system can feel overwhelming at first — but once you understand how taxes, NI, pensions, and salary sacrifice work, everything becomes much clearer.

Your take-home pay might look smaller, but that’s mostly down to how tax, National Insurance, and pension contributions are structured in the system.

If you’re planning your move, budgeting for your family, or comparing job offers, use the tools below to help with your planning:

👉 UK Take-Home Pay Calculator

👉 London Cost of Living Calculator

Everything shared here is for general information only — a mix of research, real-life experience, and practical tips. It isn’t financial, tax, legal, or professional advice, and everyone’s situation is a little different.

Before making decisions about money, tax, property, immigration, or schooling, please double-check official guidance or speak with a qualified professional. Rules can change, and personal circumstances matter.

We hope this helps you feel more informed and prepared, but only you can decide what’s right for your own situation.